Raise the curtain on Innovation Theater yet again!

We know that to create meaningful innovations that can move the needle for the companies that sponsor them, attention, resources and commitment needs to be sustained. But in too many organizations, innovation gets started, gets some traction and – just at the brink of discovering something useful – gets cut. Welcome to the world of innovation theater.

Layoffs are in the air

Predictably, firms that spent like drunken sailors during the low-interest-rate free-for-all that we’ve just been through are now reconsidering their spending as the economy looks a little soft, inflation has become a thing and investors are asking for — egads — a route to profitability!

We have seen this movie before, and it is one of the most devastating patterns that afflicts internal corporate venturing, or ICV. It’s worth bringing back some original research by Stanford’s Robert Burgelman and his colleagues to understand it.

The mystery of corporate innovation cycles

Years, ago, Robert Burgelman and co-author Liisa Vilikangas came to a perplexing conclusion. Despite all the talk about innovation, all the energy and money thrown at it and all the noise about accelerators, studios and labs, companies find it extraordinarily difficult to stick to an innovation program.

Indeed, as they observe in this article, “many major corporations experience a strange cyclicality in their ICV (Internal Corporate Venturing) activity. Periods of intense ICV activity are followed by periods when such programs are shut down, only to be followed by new ICV initiatives a few years later. Like seasons, internal corporate venturing programs begin and end in a seemingly endless cycle.”

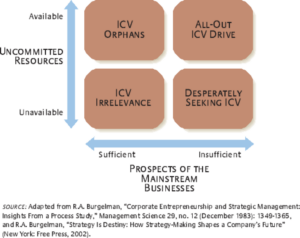

They identify two influences on how an innovation process can come to grief. The first predictor is how healthy the existing core business is in terms of growth prospects. The second is how much a company has in terms of uncommitted resources – whether that’s cash or people. What you get when you juxtapose the two is a lovely 2×2:

Corporate venturing orphans: With plentiful resources, people get resources to start new ventures, only to find that the core business is quite happy to ignore them. So, things get going, develop for a while, then wither on the vine as the core business essentially refuses to welcome them into the corporate fold.

The entrepreneurs behind such ventures either give up in frustration, leave to find a firm with a more welcoming environment or even leave to found a startup that might well compete with the original firm. The interesting story of how Zoom became Zoom is a case in point.

All-out venturing drives: In this situation, there is money to invest, company leadership knows it has a problem, and venturing becomes the holy grail. This can be useful, as it tends to raise the profile of the venturing activity and it finally attracts attention, talent and a seat at the table.

The dilemma is that senior leadership teams in a hurry are apt to put too much time pressure and expectations for rapid growth on a still-uncertain activity. This can cause them to lose faith in its prospects and terminate it before it even has a chance. IBM and Maersk’s effort to create a blockchain platform, TradeLens, feels like that to me. That venture also ignored Bent Flyvbjerg’s excellent advice to avoid complexity to the extent possible.

Venturing seems irrelevant: Here, money and talent is already committed to other things, and the core businesses’ chances are looking pretty good. So why bother with an uncertain, unproven, hard to predict new business activity when you can just ride the existing gravy train, probably for as long as is relevant for the career of a given senior leader?

What happens in this situation is that investments in new capabilities are ignored, and eventually competition catches up or makes your existing operations irrelevant. For instance, Carlson Travel was riding pretty high for a while, and evidently under-invested in technology. Carlson Travel implicitly acknowledged as it struggled through a bankruptcy that it had under-invested in its core digital technologies and customer experiences and promised to spent $100 million on getting up to speed.

Desperately Seeking Corporate Venturing! Ok, so we’ve left investing in the future too late, money is now tight, and we need to deliver something to our customers and investors PRONTO! These situations rarely end well. A desperate senior executive team might well enter into ill-considered acquisitions or now, belatedly, fund the one or two ideas that have survived being neglected.

These are often terrible ideas. See: checkered history of mainline telecom or cable companies entering the content business. AT&T’s misadventures with its forays into the media business are a case in point. Verizon’s as well. Desperation seldom leads to cool-headed dealmaking or venturing. A rare exception took place at Xerox Parc, where the invention of the laser printer saved the company after the government forced it to essentially give away its patents to other firms.

It doesn’t have to be this way!

In the next Thought Spark, I’ll describe what we think about all this at Valize, my sister company whose mission is to create predictable and reliable innovation and growth capabilities. In the meantime, please stop pouring money into innovation theater!

Or if you are really itching to start an innovation or transformation program, mail us at growth Valize to set up a time. We can get you off on the right foot. After all, there are no standing ovations for innovation theater.